In our look at employment by sector we saw that manufacturing employment has declined in developed countries even when, like Germany, they run a large trade surplus. Germany would clearly lose out if it closed its borders to all trade, but displaced manufacturing workers there still face the economic hardship of finding new jobs as productivity increases. The switch to electric vehicles, for example, is expected to cause massive layoffs in Germany’s powerhouse auto industry as it takes less labor to produce electric cars. Since manufactured goods dominate trade by value but are declining in employment relative to services due to these productivity increases, we saw that trade deficits represent fewer “lost jobs” now than in the past. At the end of the last section, we looked at the international transactions of the US and saw that we ran an overall trade deficit of around half a trillion dollars in 2019. As we discussed earlier the employment content of this deficit might be around 3 to 5 million jobs, which is significant but not game changing when stacked up against total employment of 150 million. However, in addition to employment concerns, continuing trade deficits have other consequences.

How can the US as a country continue to buy more than it sells? The answer is that in fact we don’t. There is no such thing as a free lunch. Nobody is going to sell you goods and not expect something in return, and as explained in Balance of Trade in the primer, when you have a deficit in trade in goods and services, the difference is made up by the sale of other assets. In the case of the United States, that includes our large public debt, our stocks, our companies and property. Let’s say, for example, that we buy more goods and services from Germany than we sell to Germany. German companies will get more dollars from us in exchange for goods and services than they spend buying our goods and services. The German companies, or the German government, can then use those dollars to buy US Treasury securities, thus financing the US debt which we have chosen not to finance ourselves through taxes. In effect, we’ve traded US Treasuries, which are a promise to pay back money with interest in the future, for the excess in German goods we consume. It’s essentially a loan to us which gives us the ability to spend more now than we earn, but we will have to pay that money back in the future. From the German side, the loan to us is savings which cuts into current consumption but will allow higher future consumption. Another way to look at it is that, intergenerationally, we in the US are consuming now and passing at least part of the bill on to our kids.

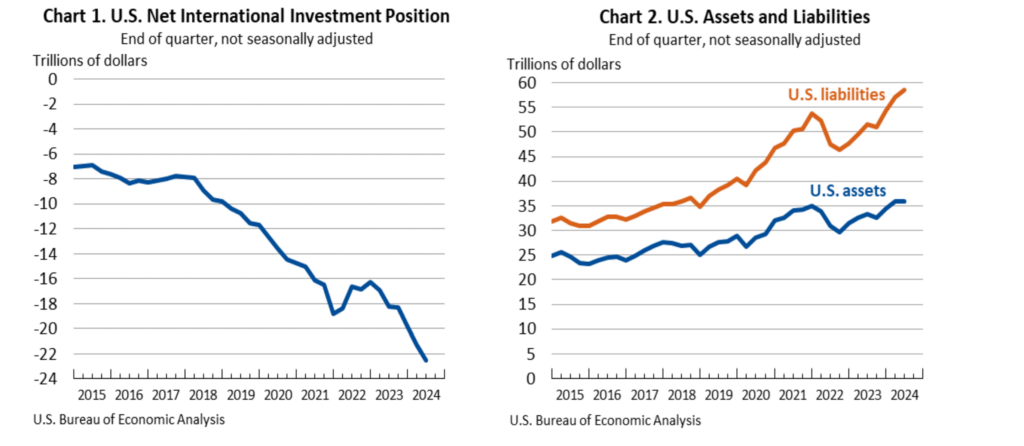

In addition to selling Government debt, we sell other assets to balance the trade deficit. Foreign companies can buy US bonds and stock directly themselves, but they can also buy such assets as real estate and US companies. They can also build manufacturing facilities in the US. US Companies and individuals have huge investments abroad. We used to be the largest net holder of foreign assets, but the trade deficit has turned that around. The charts below show that foreign governments and companies now hold 16 trillion more in US assets than we own in foreign assets.

The chart on the left shows how much more foreign countries have invested in the US than the other way around. It is the difference between US holdings of foreign assets of $35 trillion.

and foreign holdings of US assets (liabilities to us) of $53 trillion at the end of 2021. For comparison, US GDP is about $20 trillion.

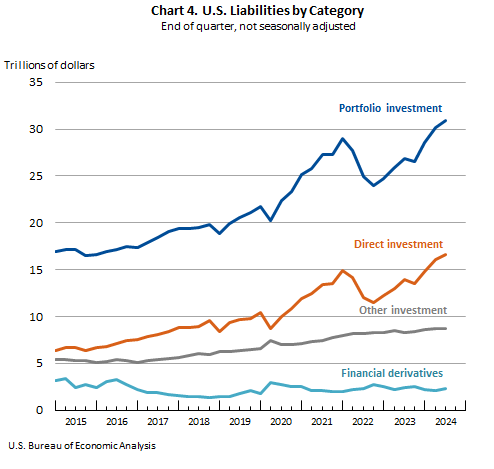

Foreign investment is classified into several forms, the two largest being “portfolio investment” consisting of such items as US Treasury bonds, US Corporate bonds, and US Stocks, and “foreign direct investment” (FDI) which includes part or full ownership of US companies, real estate, factories, and other non-financial assets by foreigners.

While foreign governments are large holders of US government debt, the largest share of portfolio investment by foreigners is in US stocks.

| Foreign Portfolio Holdings (Jun 2021) | Trillions of $$ |

| Government debt | $8.75 |

| Corporate debt | $4.73 |

| Equity | $13.71 |

| Total foreign portfolio holdings | $27.19 |

Source: US Treasury numbers for year end 2021[1]

In fact, foreigners own about 40% of US stocks compared to about 30% of US stocks which are held in domestic retirement accounts[2]!

It is interesting to see which countries have the largest portfolio stakes in the United States. The chart below shows the countries that hold more than $1 trillion in US portfolio assets (bonds and stocks etc.) according to the Treasury, along with their 2019 GDP.

Table 9: Foreign Holdings of US Securities valued at the end of June 2021

| Countries with largest US holdings | US Securities in Trillion $ | GDP of country in Trillion $ | US Portfolio % of GDP |

| Canada | $1.98 | $1.74 | 114% |

| Cayman Islands | $2.47 | $0.01 | 24652% |

| China | $1.57 | $14.28 | 11% |

| Ireland | $1.50 | $0.34 | 441% |

| Japan | $2.76 | $5.06 | 55% |

| Luxembourg | $2.30 | $0.07 | 3287% |

| Switzerland | $1.18 | $0.73 | 162% |

| United Kingdom | $2.62 | $2.83 | 92% |

| Total all countries | $27.19 |

Sources: US Treasury, World Bank[3]

Note that more US Securities are “owned” by Cayman Islands entities than China. The high multiples of holdings to GDP for the Cayman Islands, Luxembourg, and even Ireland and Switzerland give some idea of the huge amount of money being sheltered in tax havens, including money sheltered by US Corporations and wealthy individuals[4].

The second largest category of foreign held assets in the US, foreign direct investment (FDI), totals about $15 trillion. This includes the plants of foreign owned companies such as Toyota and BMW, foreign real estate holdings in the US, and US companies acquired by foreign ones. For example, in 2002, the Mexican company Bimbo acquired the US brands Sara Lee, Entenmann’s, and Thomas’ along with the other assets of Weston Foods, which was then a subsidiary of the large Canadian company, George Weston, Ltd. Many “iconic” US brands are owned by foreign companies, and of course vice versa. US FDI in other countries amounts to around $11 trillion leaving a balance of around $4 trillion more direct investment held by foreigners in the US than the other way around.

In summary, continued trade deficits are financed by selling our debt in the form of treasury and corporate bonds, equity in the form of stock, US companies and their assets, real estate, and in building new productive facilities here for foreign companies. The debt will have to be paid back in the future and foreign ownership of US assets sends income and profits abroad. Annual flows of these transactions are shown on the International Financial Transactions of the United States table shown earlier on page 108.

Selling US debt and assets to finance current spending might not be something we want to continue doing indefinitely. Balancing trade would balance the financial accounts and would result in increased employment in “tradable” goods and services. However, economists differ on how bad a trade deficit is for the US and indeed whether it is bad at all[5]. And reducing the trade deficit would certainly require sacrifices in consumption, such as reducing government debt by raising taxes, for which there seems no political will.

We should note that not all countries have the luxury of maintaining large trade deficits over a period of time without consequences. As we saw in the primer, currencies are subject to the same law of supply and demand as any product or service. For example, if Argentinians buy a lot of German cars using the Argentinian Peso, Germans will accumulate a lot of Pesos. If there is insufficient demand for Argentinian products in Germany, a trade deficit will develop. As we have seen, this can be balanced by the sale of other Argentinian assets to Germans and Germany. But if Germany doesn’t want to hold Argentinian portfolio assets, the glut of Pesos being traded for the German currency (the Euro) will cause the value of the Peso to fall. That in turn will make Argentinian products cheaper in Germany, and German product more expensive in Argentina which will in turn decrease German sales to Argentinians (e.g. fewer German cars will be sold in Argentina) and increase the sale of Argentinian products in Germany (because they are cheaper in terms of Euros). And that in turn will reduce the trade deficit.

However, it can take quite a while for trade deficits to devalue currencies even in smaller countries, and for a really large economy such as the United States, especially since the dollar is currently the world’s main “reserve currency”, the situation can go on for a truly long time. We have a lot of assets to sell and are trusted to pay off our loans.

[1] Department of the Treasury/Federal Reserve Board Treasury International Capital System https://home.treasury.gov/data/treasury-international-capital-tic-system/us-liabilities-to-foreigners-from-holdings-of-us-securities For release April 29, 2022

[2] “Who Owns US Stock? Foreigners and Rich Americans.” 2020. Tax Policy Center. October 20, 2020. https://www.taxpolicycenter.org/taxvox/who-owns-us-stock-foreigners-and-rich-americans. This includes shares held in financial portfolios and shares acquired through FDI.

[3] https://home.treasury.gov/data/treasury-international-capital-tic-system/us-liabilities-to-foreigners-from-holdings-of-us-securities (June 2021 data) and https://wits.worldbank.org/CountryProfile/en/country/by-country/startyear/LTST/endyear/LTST/indicator/NY-GDP-MKTP-CD (2019 data). GDPs were higher in 2021.

[4] These “offshore financial centers” are popular for a variety of reasons and tend to specialize. They are low or no tax, have minimal reporting requirements, provide secrecy, and have streamlined set up and administration requirements. Most of the world’s hedge funds and many US mutual funds are Cayman based.

[5] See for example https://www.cfr.org/backgrounder/us-trade-deficit-how-much-does-it-matter and https://www.investopedia.com/articles/investing/051515/pros-cons-trade-deficit.asp#:~:text=A%20trade%20deficit%20is%20neither,running%20country%20in%20the%20future.