We’ve looked at spending and found that while government spending has risen very modestly as a fraction of the economy, government tax revenues have fallen. We’re running an enormous deficit that can only be closed by raising revenue or decreasing spending. Spending cuts would have to come out of the programs that have somewhat lessened growing income and wealth inequality in the US, programs such as Social Security and Medicare and the Affordable Care Act. The growth in deficits has been fueled by reductions in taxes primarily benefiting the wealthy since Reagan’s time. Since cutting spending on social programs would have been unpopular, Republican administrations simply increased deficit spending, financed in part by “borrowing” the Social Security Trust Fund. It is time to reverse this trend. Income and wealth inequality have grown enormously. As during the gilded age, tax increases are necessary to somewhat flatten the income and wealth distribution. Democracy itself is distorted and threatened by such concentrations of income and wealth. The wealthy do not need trillions to live on, they can get by quite comfortably on a few million a year. As it is now, we’re saddling our kids with debt to finance tax cuts that benefit the wealthy most while maintaining social spending.

We need the money. We have seen that about half the US population struggles to make a basic living. To quote a recent Brookings article:

Prior to COVID-19, almost half of the American workforce (44 percent or 54 million workers) earned low wages, with a median annual salary below $18,000. About half of low-wage workers had a high school diploma or less, with only 14 percent holding a bachelor’s degree. Moreover, our research has shown that most low-wage workers churn through low-wage jobs, struggling to move up in a labor market with declining and uneven access to development and advancement opportunities[1]

With the advance of technology, there is simply less demand for labor. Since it is far from apparent that this situation will be changing any time soon if ever, other methods of apportioning the benefits of all this productivity have to be found.

On top of that, we need to invest money. To quote the Brookings article again

Public spending on physical infrastructure has persistently failed to keep up with economic growth; the U.S. spends only 2.3 percent of GDP on infrastructure, while European countries spend 5 percent on average and China spends about 8 percent. Just to meet basic national needs by 2025, the U.S. faces an estimated funding shortfall of more than $2 trillion. Several more trillions in spending on clean energy and climate change adaptation and mitigation will be needed to achieve carbon neutrality by 2050.

Climate change and sustainability due to human population growth and consumption are crisis as real as an advancing army. As during times of war, more revenue must be raised. There is a difference though. Investments in climate change and sustainability often yield returns far in excess of their costs. Sun and wind are free once you build the infrastructure to harvest their energy. If we don’t invest in these technologies, we cede the field to those who do, most notably the Chinese.

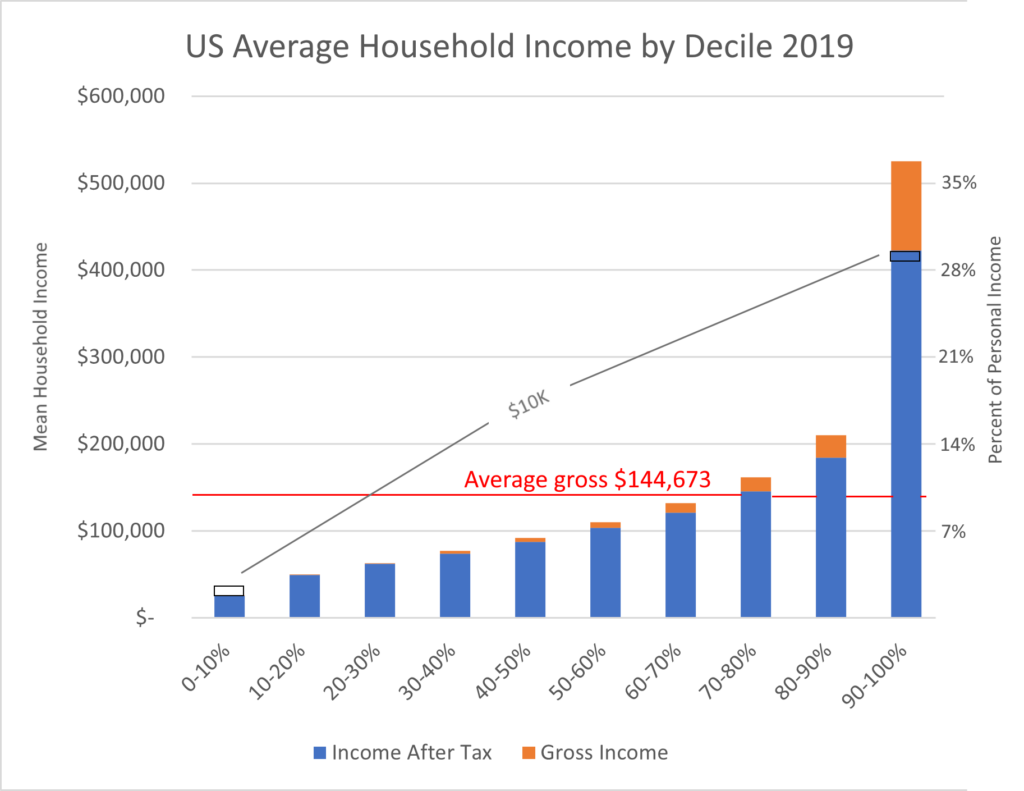

As I have said many times already and will do again, the US is a very rich country. There is plenty of money (output, productivity) to go around. Everyone in the US could live a comfortable middle-class lifestyle based on current GDP if labor was paid more equally. There are many ways to accomplish that with a bit of imagination and will. Most economic programs start by listing all the great things they are going to do and either skip the part about how to pay for them or put it at the end. Let’s do it the other way around. Here’s the income distribution by percentage of households from earlier.

Figure 34 US mean (average) household income by decile group. Note that since the groups include the same number of households, this also shows the distribution of income: the 0-10% group has 1.8% of the total income while the 90-100% group has 36.6% pre-tax. The small black rectangles on the first and last bars are $10,000. The red line shows the income all households would have if personal income was evenly distributed. Personal income does not include capital gains. Data source: https://www.bea.gov/data/special-topics/distribution-of-personal-income WW126

Pretty clear why the upper 10% pay more income taxes than other groups, they make more. As we’ve seen within the top 10% income is even more skewed. Note that this accounting of income does not include capital gains, realized or not. It is not Elon Musk’s or Jeff Bezos’ untold billions that inflate this number, this is actual income received in a year. It also does not include all the money that is used to run a business such as depreciation and capital investment. In short, even if somehow all households participated equally in national income, the owners of capital and businesses would retain their wealth and could grow that. The capitalist engine that is so productive would continue to chug along unaffected by income redistribution. Jeff Bezos as we’ve seen, took a very modest wage at Amazon. That didn’t prevent the company, and his net worth from growing exponentially.

Even if the political will were there, realistically we wouldn’t be able to flatten the income curve completely, but we certainly can do better than the current one. The rich might have to limp along on a pre-Reagan share of national income, but they would still have incomes in the millions and unlimited wealth. There is no reason that half the US population has to struggle along on low incomes and no wealth. The money is there. How do we go about flattening the curve?

One obvious first step is to go back to New Deal thinking and tax the rich again. We need to

raise marginal rates and brackets back to those that were in place during the boom times following WWII. Most of the benefits of the tax cuts have gone to high income households. As we saw on page 21, the shift in income to just the top 1% since Reagan’s time amounts to $2.3 trillion a year, and the rich were hardly starving before then.

We also badly need tax reform: the 7,000-page tax code needs weeding and the elimination of special interest tax breaks to reduce or eliminate “spending through the tax code”. That spending currently costs $1.7 trillion a year.

Tax evasion amounts to another $1 trillion lost a year, mostly from the wealthy. Beefing up enforcement would bring in much of that.

Increase the inheritance tax on large fortunes. It might be fair to allow entrepreneurs to amass huge fortunes during their lifetimes, but it is not fair to allow generations of their offspring to inherit huge fortunes. Small ones are enough.

The above measures could generate over $4 trillion a year in additional revenue, which was roughly the size of the entire Federal budget in 2019.

Let me mention a couple of taxes I’m not for. I’m not for a high corporate tax rate because that would put a tax on business, and in particular US businesses. While I’m against a higher corporate income tax rate, I’m for the elimination of tax shelters, which can only be done at the international level. Let’s go for a low but uniform corporate tax rate that all companies pay.

Another tax I’m not for is a tax on wealth. This may seem surprising given that wealth is even more concentrated than income. The top one percent of the income distribution in the US holds more wealth than the bottom 80 percent[2]. But there is no need for a wealth tax to address wealth inequality, a properly designed, progressive, income and inheritance tax is sufficient, and there are a lot of difficulties in trying to implement a wealth tax. It’s pretty easy to move wealth around or hide it, and valuation is difficult. Furthermore, I’m just fine with Jeff Bezos being extremely wealthy, I don’t begrudge him his superyacht. Bezos came from a middle-class background, as did many of the wealthiest, and built a business that significantly increased productivity in a number of areas. Whatever one might think of some of the tactics involved, the Carnegies, Fords, Morgans, Gates’, Musk’s, and Bezos’ of the world move the productivity needle. But what about their heirs? Here we run into one of my prime Enlightenment principles: equality of opportunity. It is also amusingly somewhat Nietzschean, and certainly free market: if we assume that human talent is widely distributed, then to maximize productivity, everyone should have an equal chance to make their contribution and earn their economic and other rewards. Realistically, if you can pass on a few million dollars to each of your kids, great. But beyond that, no. As Bill Gates has said “It’s not a favor to kids to have them have huge sums of wealth. It distorts anything they might do, creating their own path.”[3] And it certainly isn’t fair to the homeless kid. High marginal income tax rates and inheritance taxes could be designed to ensure that vast wealth is not passed on from generation to generation.

[1] Gandhi, Dhruv, Marcela Escobari, and Sebastian Strauss. 2021. “How Federal Infrastructure Investment Can Put America to Work.” Brookings. March 17, 2021. https://www.brookings.edu/articles/how-federal-infrastructure-investment-can-put-america-to-work/.

[2] Six facts about wealth in the United States | Brookings

[3] Mick Jagger Bill Gates May Not Leave Massive Inheritance