As we saw in Figure 5, income tax collections as a percent of GDP have come down, while Social Security and Medicare taxes (also called payroll or FICA taxes) have stayed pretty constant. Payroll taxes are predominantly paid by the middle class and poor as a fixed percentage of income with a cap. A middle-class household pays 15.3% of their income in payroll taxes while a household in the top one percent paid an average 2.2 % in 2020[1]. On the other hand, most income tax is of course paid by those with the most income even in the absence of progressive tax rates. The five percent of GDP decline in income and corporate taxes between 1952 and 2022 shown in Figure 5 equals about $1.36 trillion per year in lower revenue now, most of that going to the wealthy. So, there has been a shift in the tax burden when total revenue is considered.

Table 3 shows the highest marginal tax rates and number of brackets for some years. A tax bracket is a range of income. For example, in 2000, income below $43,850 was taxed at a 15% rate, any income above that and below $105,950 was taxed at 31% rate. As can be seen, during the boom times following WWII there were many brackets and the top marginal rate was over 90%. The wealthy now pay a maximum rate of 37% on income above $693,750. Corporate income tax rates have also come down, but Social Security and Medicare taxes have gone up.

Table 1 Tax Rates/Brackets for married filing jointly. Sources: https://www.whitehouse.gov/omb/budget/historical-tables/ historical income tax rates, https://www.ssa.gov/oact/progdata/taxRates.html, https://taxfoundation.org/data/all/federal/historical-corporate-tax-rates-brackets/

| Year | Highest Marginal Personal Income Tax rate | Number of Brackets | FICA rate (Payroll Tax) | Highest Corporate Income Tax rate | Capital Gains rate |

| 1960 | 91% | 25 | 6% | 52% | 25% |

| 1975 | 70% | 33 | 11.70% | 48% | 35% |

| 2000 | 40% | 5 | 15.30% | 35% | 20% |

| 2023 | 37% | 6 | 15.30% | 21% | 20% |

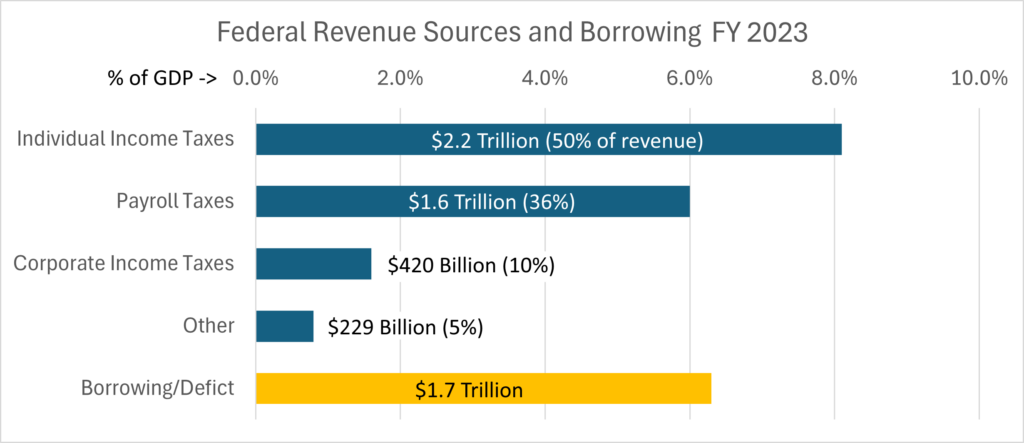

The chart below shows a snapshot of how the Federal Government paid for outlays in 2023. Most Federal revenue came from individual income taxes (53%), Social Security and Medicare (FICA) payroll taxes were one third, corporate income tax contributed a bit less than 10% and everything else was around 5%. Estate and gift taxes contributed less than 1%. To make up for the budget deficit, we borrowed more than payroll taxes bring in!

Figure 7 Federal Revenue Sources and Borrowing 2023 as a percent of GDP. Source: https://www.cbo.gov/publication/59727 WW131

Let us look at these sources in a bit more detail.

Payroll Taxes

The payroll or FICA tax is the simplest of the taxes. Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes are pretty high: 6.2% of wages paid by the employer and 6.2% paid by the employee for a combined 12.4%[2]. But that is up to a wage limit of $160,200 in 2023. Someone earning $10 million a year in wages paid the same $19,865 in Social Security contributions as someone earning $160,200. There is no lower limit on the wages taxed. The Medicare tax rate is 1.45% for both employer and employee and there is no cap. Payroll taxes are only paid on wage or salary income. They are shown in orange in Figure 5.

Income Taxes

Individual income taxes are paid on total income which includes wages, realized capital gains, dividends, and pass-through business income. But the rates on each of these types of income are different.

We all understand the tax on wage income. It’s taken out of our paychecks. The rate is from 10% to 37% currently depending on your wage or salary.

Realized capital gain income is what you make from selling an asset such as a stock or house over what you paid for it. Until the asset is sold, there is no “realized capital gain” for tax purposes. In 2018, Jeff Bezos the Amazon CEO had salary of $81,840. His total compensation package came to $1,681,840. But since he owned roughly 16% of Amazon, the value of his stock went up about $27 billion. None of that unrealized $27 billion in appreciation counted as income for tax purposes. This allows great wealth to be built essentially untaxed. When you do sell, the tax rate on capital gains is 20% (or lower if your income is below $492,300). That rate is much lower than the tax on wages would be for the same amount, and there is no payroll tax.

Dividend income is income you receive often from owning a stock which pays out profits to stockholders. They were taxed at the same rate as wages until the George W Bush tax bill of 2003. They are now taxed at the same rate as realized capital gains (20% or lower)[3]. Dividends like capital gains go disproportionately to the wealth since they own a lot of stock. No payroll tax is paid on dividends.

Pass-through business income is profit from a privately owned business, such as an S-Corp, which is “passed through” to the business owners. Pass through income is taxed like wage income, except no payroll tax is assessed. In the Trump administration tax bill of 2017, which lowered the top income tax rate, a 20% deduction for pass through business income was created. The pass-through rate is currently 20% lower than for wage income. As we saw in Part 2, some very large privately owned US corporations, such as Mars Inc., the candy company, are organized as pass through businesses.

Corporate Income Tax

The corporate income tax is a tax on the profits of companies organized as “C Corps” for tax purposes. The 2017 tax bill lowered the corporate income taxes rate from a maximum of 35% down to 21%. To be fair, a lot of large profitable US companies were able to pay no or minimal corporate income tax before 2017 by utilizing various loopholes. The 2017 bill, the Tax Cuts and Jobs Act or TCJA, was designed to reduce the incentive for multinational US companies to “book” profits through subsidiaries in low tax countries among other things. The jury is out on whether that has happened, but one effect has been to reduce corporate taxes collected by 40 percent[4].

.

Other Revenue Sources

There are other smaller sources of revenue for the Federal Government such as excise taxes. The estate tax brings in less than 1% of revenue.

Spending Through the Tax Code

One can download the Internal Revenue Code, Title 26 of the laws of the US, from a congressional site. The Federal tax code is 7,058 pages long. By comparison, Title 24 – Hospitals and Asylums, is 89 pages. Clearly it is a life’s work to get a handle on the tax code and keep up to date with changes. All recent Presidents have decried the complexity of the tax code and promised to try to simplify it and eliminate “loopholes”. The Mercatus Center, often described as a conservative think tank, said of the 2017 Trump administration tax reform effort “If recent history is a guide, and if special interests are able to dictate the terms of the debate on Capitol Hill, an attempt to de-rig the tax code will turn into a re-rigging.”[5] The liberal Center for American Progress’ analysis of the resulting legislation suggests that indeed re-rigging occurred just as it has in the past[6]. Economists from across the conservative/liberal spectrum agree on the need for tax reform, as they do on a surprising number of economic issues.

The tax code is long and complex for many reasons, including the accumulation of provisions over the years, frequent amendment, the need to provide detailed instructions for the many types of entities and transactions covered, and special tax breaks which are referred to as “spending through the tax code”.

While tax breaks are often ostensibly enacted to serve some desirable end, it is estimated that “spending through the tax code” cost over $1.6 trillion in 2023. Here are some of the biggest breaks for individuals:

Table 2 Federal Tax Expenditures[7]. Note that in this table, Earned Income Credit outlays, not just tax credits, are shown. Those are also shown in the table on Federal Outlays above.

| Row | Expenditure | Annual Cost (Billions) |

| 1 | Reduced Rates of Tax on Dividends and Long-Term Capital Gains | $238.80 |

| 2 | Defined Contribution Plans | $193.40 |

| 3 | Exclusion of Employer Contributions for Health Care, Health Insurance Premiums, and Long-Term Care Insurance Premiums | $187.40 |

| 4 | Credit for Children and Other Dependents[RF1] (includes Earned Income Tax Credit) | $184.70 |

| 5 | Defined Benefit Plans | $94.70 |

| Total (All 165+ Expenditures) | $1,721.20 |

The total is about the same as all discretionary spending in the budget. What purposes do these tax breaks serve?

Capital gains tax rates (row 1) have long been lower than income tax rates. One reason given is the need to account for inflation in figuring gains. If you hold a stock worth $10,000 and inflation runs 3% a year, in twenty years your stock would have to be worth $18,061 to have kept up with inflation. So, it would be unfair to have to pay a tax on the $8,061, you would have been better off spending the $10,000 in the first place[8]. Stock dividends are corporate profits distributed to shareholders. In 2003, the tax on those distributions was lowered for several stated reasons, one being that corporate profits were already taxed, and taxing the distributions was double taxation. As we will see, actual taxation of corporate profits is spotty at best.

Defined contribution and benefit plans (rows 2 and 5) allow the employee and employer to contribute pre-tax money to retirement plans such as IRAs and 401Ks. This reduces income taxes and is designed to encourage individual retirement saving. Employer contributions are usually linked to income: the higher the income, the higher the matching and allowed contributions.

Credit for children and, as of 2017, other dependents (row 4) are partially refundable tax credits of up to $2,000 per child or $500 per dependent. You can get this credit in full against your taxes if your jointly filing income is below $400,000. When enacted in 1997, it primarily benefitted middle- and upper-middle-income families since poor families could only claim a credit against any income tax they owed[9]. The credit is now partially refundable, meaning poor families can get a check of up to $1,600 annually per child even if no taxes are owed, subject to some conditions and limitations.

Row 4 also shows Earned Income payments, both tax credits and the much larger amount that is refunded (i.e. payments when no further income tax is due). These are also shown in the line on spending for income security in Figure 3. Earned Income Tax Credit (EITC) refunds are primarily directed to low income working households with children. This program is the US’s main antipoverty program. EITC payments have kept many poorer families just above the poverty line.

While each of the above tax expenditures has a stated purpose or purposes, more than half the benefits go to the top twenty percent of households[10].

There are also “tax spending” breaks for corporations and certain industries such as oil and mineral extraction and agriculture that that are included in the trillion and half dollar total.

Corporate Tax Avoidance

In addition to spending through the tax code, there are enormous losses of tax income through legal tax avoidance and illegal tax evasion. We will look first at corporate tax avoidance.

Between 2018 and 2020 a few of the US companies with income in the billions that paid zero in corporate income taxes include Archer Daniels Midland, Edison International, FedEx, Principal Financial, Salesforce.com and T-Mobile[11]. How is that possible? Simply put, these companies, and many others like them, report billions in profits to their shareholders but use tax provisions and dodges to report lower or no profits to the IRS. Between 2018 and 2020 in particular, the tax reform act of 2017, the “Tax Cuts and Jobs Act” or TCJA, allowed companies to write off capital investment immediately for tax purposes instead of depreciating it over a useful lifetime as is usual in accounting.

A different, long-standing, way to avoid US taxes for US corporations is to “book” profits through foreign countries with ultra-low corporate tax rates. We have seen these tax havens before in Part 2 when we looked at tiny countries such as the Cayman Islands that “own” several trillions in US assets. Booking profits through a tax haven can be accomplished via a “corporate inversion” in which a company forms a corporate entity or buys a company in the tax shelter country and makes that company the corporate owner with the US company a subsidiary. A more popular gimmick is to use “transfer payments” along with intellectual property (e.g., patents or trademarks such as the Nike “Swoosh” which “belongs” to a paper subsidiary in Bermuda)[12]. How does this work? For tax purposes, companies can assign earnings to different subsidiaries around the world. For example, if a US based pharmaceutical company makes pills at a Puerto Rico subsidiary, it can assign or “sell” the patent for that drug to the subsidiary and pay monopoly pricing for the “imported” pills. The pills can then be sold in the US for minimal markup over the already inflated price resulting in most of the profit being assigned to the Puerto Rican subsidiary where corporate taxes are much lower. The big pharmaceutical companies are avid users of this tax strategy, reporting 75 percent of their taxable income in foreign subsidiaries while notoriously charging their highest prices and making most of their sales in the US[13]. The IRS recently billed Amgen $11 billion in back taxes and penalties for just one of these transfer payment schemes.

Apple is a notoriously profitable company and has in the past been a poster child for tax avoidance. Wikipedia’s account is almost funny for those of us not familiar with the world of international tax gaming:

ASI is an Irish-registered subsidiary of Apple Operations Europe (“AOE”). Both AOE and ASI are parties to an Irish advanced pricing agreement which took place in 1991. ASI is the vehicle through which Apple routed €110.8 billion in non–US profits from 2004 to 2014, inclusive. ASI’s 2014 structure was an adaptation of a Double Irish scheme, an Irish IP–based BEPS tool used by many US multinationals. Under the Double Irish structure, one Irish subsidiary (IRL1) is an Irish registered company selling products to non–US locations from Ireland. The other Irish subsidiary (IRL2) is “registered” in Ireland, but “managed and controlled” from a tax haven such as Bermuda. The Irish tax code considers IRL2 a Bermuda company (using the “managed and controlled” test), but the US tax code considers IRL2 an Irish company (using the registration test). Neither country taxes it[14].

While in this case the sales occurred outside the US, at that time Apple would have been liable for US corporate taxes on these profits. By leaving the profits overseas Apple was able to avoid taxes until the money was brought back to the US. The 2017 tax reform included a tax break on bringing back money accumulated overseas, and Apple is making use of that to repatriate around $250 billion of accumulated cash at a lower tax rate[15]. American Fortune 500 companies held an estimated $2.6 trillion offshore in 2017, presumably as a result of tax avoidance schemes such as these[16].

Not all US companies can move profits around like this and so the corporate tax burden is unevenly distributed and favors large international companies, especially ones with a lot of intellectual property. In 2022, corporations overall paid total income taxes of 16% ($425 billion) on domestic profits of $2,736 trillion which, given the corporate tax rate of 21%, leaves 5% or $136 billion uncollected for one reason or another[17]. To make collections fairer, the Inflation Reduction Act of 2022 included a minimum corporate tax applicable to large companies of 15% of the profits they declare to shareholders.

Individual Tax Avoidance

In 2021 ProPublica reported some findings on a trove of IRS data it had received. The article starts as follows:

In 2007, Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011. In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes[18].

How is it possible for multibillionaires to pay little or nothing in taxes in a year when their wealth increases by billions? As we’ve seen, the trick is to have unrealized capital gains but low or no net income. If the value of Bezos’ Amazon stock goes up by $27 billion in a year but he does not sell any of it, he doesn’t have to pay any taxes on that unrealized capital gain. So said the Supreme Court in 1920. Ever since that time, the rich have been able to use a tax avoidance strategy called “buy, borrow, die” which works like this: (1) buy or build assets such as a company, (2) instead of paying yourself a salary or selling stock, borrow money using your assets as collateral, (3) never sell your assets and pass them on to your heirs or favorite charities when you die. Repeat.

It may not be immediately obvious why borrowing money would be a better idea than selling stock or earning a high income. Consider, if the maximum tax bracket is 37%, you would have to pay roughly that rate if you took a million dollars a year in salary. Or you could sell assets such as stocks and pay a 20% capital gains tax on the appreciation. But if you borrow a million dollars instead, using your stock as collateral, you only pay, say, 5% interest annually. Meanwhile, your stocks or other assets often grow at much higher rates, so you are effectively making money by borrowing on your wealth. There is no tax on borrowed money, and in fact if you use the money to buy investment property, the interest is tax deductible. Unlike the interest on a credit card.

What happens when you die? Federal estate taxes only applies to estates worth over $13 million net of debt and charitable bequests. Surviving spouses are exempt. What is more all estates get what is called “stepped up basis” meaning that the stock, business, real estate, or other assets you inherit are immediately assigned their value as of the date of inheritance. If you subsequently sell the asset, you only pay capital gains tax (maximum 20%) on the gain since you inherited it, not on the entire gain since the asset was first bought.

What about estates larger than $13 million? To quote Investopedia, “The portion of the estate that’s above this $12.92 million limit in 2023 will be taxed at the top federal statutory estate tax rate of 40%. In practice, various discounts, deductions, and loopholes allow skilled tax accountants to reduce the effective rate of taxation to well below that level.”[19]

These techniques and others allow the rich to build wealth while avoiding income and capital gains taxes. Depending on the size of the estate, most or all of that wealth can be passed on to heirs on a stepped-up basis thus permanently avoiding even capital gains taxes on the increase. This kind of tax avoidance is less effective for those earning most of their income as wages, which includes everybody right up to the 99th percentile as we saw in Part 2.

Tax Evasion

Above we looked at legal ways corporations and individuals avoid taxes. Tax evasion refers to illegal methods of reducing taxes. Estimates of the annual loss just for US Federal taxes run as high as $1 trillion per year, although the official IRS “tax gap” between what it collects and what it estimates is due was $688 billion in 2023[20]. That means that about 85% of taxes due are paid eventually, leaving about one dollar in six unpaid. Most tax evasion is simply understating income in a way that is easy for auditors to detect, but wealthy individuals can use shell companies and accounts in tax haven countries to hide money in ways that are difficult to untangle. High value tax audits take considerable resources and, until recently, the IRS was starved of resources despite the fact that each dollar spent on investigating complicated tax returns yields about six dollars in taxes and fines[21].

[1] Effective tax rates, CBO, as complied at https://www.taxpolicycenter.org/statistics/historical-average-federal-tax-rates-all-households

[2] Self-employed pay both parts, currently 15.3%. The split between employer and employee is cute but employers figure the cost of labor based on all costs including taxes and benefits. So, the entire amount really is “paid for” by employees in the form of lower after-tax wages. In exchange we get guaranteed, inflation-protected, life-long income with survivor benefits.

[3] There are further details omitted for simplicity that don’t materially change the effect

[4] https://www.pgpf.org/blog/2024/05/how-did-the-tcja-affect-corporate-tax-revenues#:~:text=The%20changes%20to%20corporate%20taxation,the%20law%20was%20in%20effect.

[5] https://www.mercatus.org/economic-insights/expert-commentary/tax-reform-will-trump-really-stand-special-interests

[6] https://www.americanprogress.org/article/broken-promises-special-interest-breaks-loopholes-new-tax-law/

[7] The source for this table is the Tax Foundation https://taxfoundation.org/blog/largest-tax-expenditures-saving-investment-tax/ which is based on a Joint Committee on Taxation report. The Treasury also has data on all tax expenditures at https://home.treasury.gov/policy-issues/tax-policy/tax-expenditures.

[8] Some have suggested indexing capital gains to account for inflation.

[9] https://crsreports.congress.gov/product/pdf/R/R45124/4#:~:text=The%20child%20tax%20credit%20was%20created%20in%201997%20by%20the,incur%20when%20they%20have%20children.

[10] https://www.taxpolicycenter.org/publications/distributional-effects-individual-income-tax-expenditures-after-2017-tax-cuts-and-jobs/full. This data is charted at Policy Basics: Federal Tax Expenditures | Center on Budget and Policy Priorities (cbpp.org)

[11] https://itep.org/corporate-tax-avoidance-under-the-tax-cuts-and-jobs-act/?gad_source=1&gclid=Cj0KCQjw6PGxBhCVARIsAIumnWZnXISBtQLAZ_T9qEAYliR-p49ts3WvOGeJXE5f3OWamzI3dJI1F0gaAthfEALw_wcB .

[12] https://www.icij.org/investigations/paradise-papers/swoosh-owner-nike-stays-ahead-of-the-regulator-icij/

[13] https://www.finance.senate.gov/chairmans-news/wyden-releases-new-findings-in-ongoing-pharma-tax-investigation

[14] https://en.wikipedia.org/wiki/Apple%27s_EU_tax_dispute#:~:text=ASI%20is%20an%20Irish%2Dregistered,from%202004%20to%202014%2C%20inclusive see also Apple Sidesteps Billions in Taxes and Profits at Apple’s subsidiary in Ireland rise to $69bn

[15] https://www.forbes.com/sites/kellyphillipserb/2018/01/17/apple-says-it-will-bring-cash-back-to-us-pay-38-billion-in-repatriation-tax/?sh=34f293002222

[16] https://www.imf.org/en/Publications/fandd/issues/2019/09/tackling-global-tax-havens-shaxon

[17] Profits source: Corporate profits with inventory valuation and capital consumption adjustments from U.S. Bureau of Economic Analysis, “Table 6.16D. Corporate Profits by Industry” (accessed Tuesday, June 4, 2024). Taxes paid source: US Treasury Dept https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/

[18] https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

[19] https://www.investopedia.com/articles/personal-finance/120715/estate-taxes-who-pays-what-and-how-much.asp

[20] https://www.budget.senate.gov/chairman/newsroom/press/whitehouse-offshore-tax-evasion-by-big-corporations-the-wealthy-cheats-american-people#:~:text=The%20IRS%20estimates%20tax%20cheats,gap%20could%20be%20%241%20trillion.

[21] https://www.cnbc.com/2024/02/22/tax-evasion-by-wealthiest-americans-tops-150-billion-a-year-irs.html

[RF1]Does this include the earned income tax credit? See https://www.pgpf.org/budget-basics/tax-expenditures

The source for this chart is the Tax Foundation https://taxfoundation.org/blog/largest-tax-expenditures-saving-investment-tax/