For almost all people around the world, income comes mostly from labor, and their “wealth” is built from saving and investing from a labor income. “The American Dream”, is an amorphous concept but in economic terms it usually refers to “the belief that anyone, regardless of where they were born or what class they were born into, can attain their own version of success in a society in which upward mobility is possible for everyone.”[1] But, as we all know, the playing field isn’t level. While it is true, as we’ve seen, that people with extraordinary abilities can rise to great wealth from almost any country and background, in the aggregate children of poor people tend to have lower incomes and wealth than children of better off parents. That said, the extent to which children’s earnings reflect their parents varies between countries and over time. What can we say about current economic mobility and its determinants?

First of all, it is important to differentiate between absolute and relative incomes. As the economy grows, one would expect children to earn more in real terms than their parents even if they are in the same position on the earnings scale relative to their peers. In other words, if I’m in the 5th percentile of earnings now, I will still make more than my parents who were also in the 5th percentile at the same time in their lives, at least if GDP per capita has gone up in the meantime and inequality hasn’t changed. That is called “absolute” income mobility. By contrast, “relative” income mobility relates to how closely a child’s earnings are tied to their parents. If my parents were in the 5th decile of earnings, how likely is it that I’ll be in the top 10 percent?

We’ve looked at absolute income mobility in our discussion of GDP per capita growth and its distribution over the working population. In the US, for example, we’ve seen that GDP per capita has increased but so has income inequality, so that absolute intergenerational income has increased more for the top of the income distribution than it has lower down in the distribution.

What do studies say about relative intergenerational income mobility?

Income mobility is often measured by looking at the correlation of parent and child income. Let’s say Bob’s father made twice as much as Ted’s (100% more). Then if Bob now makes twice as much as Ted, the correlation is perfect, a correlation of 1. If Bob only makes 50% more than Ted, then the correlation is .5, if he makes 20% more the correlation is .2. Of course, this statistic is estimated by using income data on a lot of fathers and sons. Looking at how this statistic is measured reveals some obvious problems. For example, why fathers and sons rather than family incomes? Also, it is clear that long term income data is needed for both the parents and children since income varies over a lifetime. It is hard to get such data, especially in comparable form.

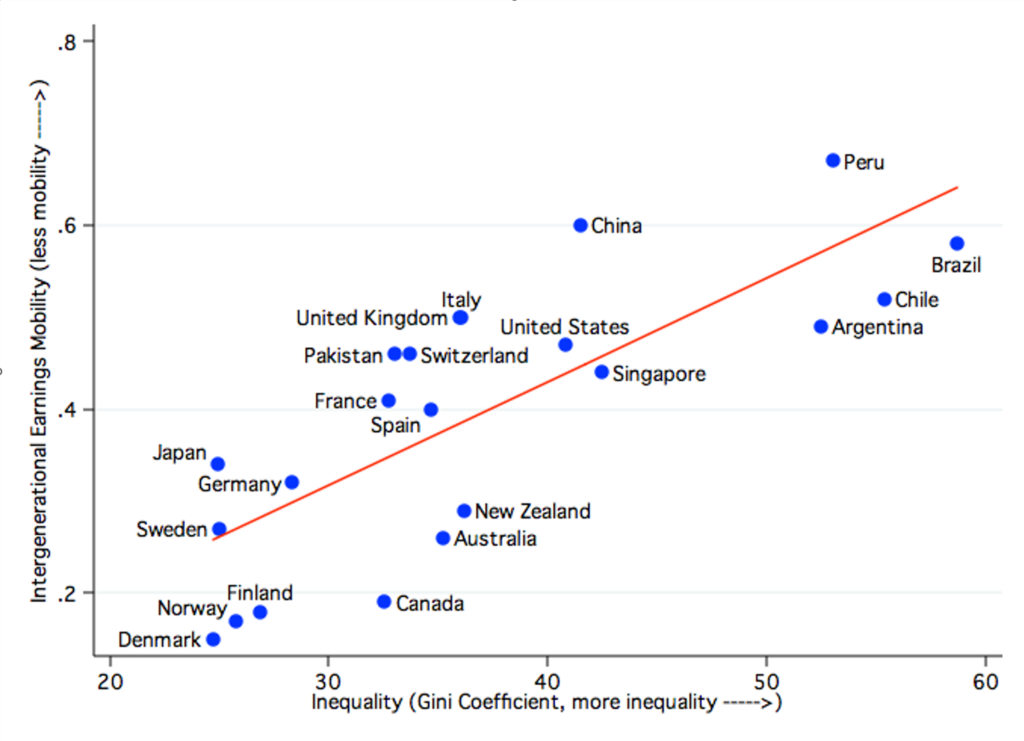

Economists are well aware of these issues and do their best to account for them. Given the caveats, here is a chart that shows income persistence, the correlation we just discussed, plotted against income inequality as measured by the Gini index. It’s often called “The Great Gatsby Curve”. In the chart, inequality goes up towards the right, and “income persistence” or the lack of mobility goes up toward the top. Norway, Denmark, and Finland are at the low end of inequality and have the most intergenerational income mobility, the United States is towards the middle and several South American countries are at the high end, with high inequality and low income mobility.

Figure 56: The “Great Gatsby Curve” – Intergenerational income persistence (more persistence means less mobility) plotted against income distribution inequality. Source: Miles Corak blog post and paper[2]

It is not surprising that high income mobility and lower income inequality go hand in hand: if everyone earned nearly the same income, the small differences remaining would be unlikely to correlate with parents’ income. At the other end of the spectrum, high income inequality often indicates that at least part of the population isn’t able to climb the economic ladder easily. Peru, which sits high on the income inequality scale and low on the mobility scale is oddly a country that has made great strides in reducing poverty: absolute mobility is high because people’s incomes have grown, but relative mobility is low since the same groups tend to stay in the same place on the economic ladder. In Peru, as in many countries, some rural areas are economically depressed, and children that stay close to home have limited opportunity to grow their incomes. Also in many countries, there are groups that are at a disadvantage because they aren’t fully integrated into the economy for one reason or another. In Peru, native speakers have significantly less mobility than Spanish speakers[3].

Worldwide, it is very difficult to get income data on parents and their children over generations, so major studies of income mobility tend to look instead at factors that correlate with it. The World Bank’s 2018, 300-page, study of economic mobility relies heavily on educational mobility which correlates strongly with income mobility in countries for which both measures are available[4]. Educational mobility data is far more widely available than income data. We should note that correlation does not equal causation: it is not necessarily true that increasingly widespread education results in more widespread earnings opportunity, but they do go hand in hand. The study finds that, in the aggregate, there is good news and bad news worldwide. To quote a few results: Sons and daughters are on average better educated than their parents almost everywhere. However, the developing world today is roughly where the high-income world was 40 years ago. Gender gaps in educational mobility are closing fast. Mobility from the bottom half of the education ladder to the top quartile has fallen over time in developing economies, whereas persistence at the bottom has increased. The study also finds that average relative mobility for economies in South Asia and Africa is significantly lower than that for the other developing regions, and that in in several developing economies, mostly in Africa, the Middle East, North Africa, and Latin America, income mobility trails behind educational mobility which suggests that jobs making use of the extra education aren’t available.

Another large study of worldwide mobility by the World Economic Forum avoids the statistical correlation route entirely and looks instead at factors that can be reasonably assumed to increase or decrease social mobility[5]. These include such indicators as health access, adolescent birth rate, education and its quality, technology access, work opportunities, fair pay, and measures of political corruption and stability. By assigning scores to each area, say “percent of rural population with electricity”, the report comes up with a ranking for countries by social mobility which correlates well with the income mobility we see in The Great Gatsby Curve, but spans many more countries. This report, like others, shows the Nordic countries and parts of Europe outperforming the rest of the world in mobility. Further down the list, of the 82 countries ranked, Canada ranks 14, the US 27th, China ranks 45th, and South Africa ranks 77th. The report estimates that if countries included in this report were to increase their social mobility index score by 10 points, this would result in an additional GDP growth of 4.41% by 2030 in addition to vast social cohesion benefits. The rankings also show that: countries that adhere to the “stakeholder capitalism” model tend to perform better than countries with a focus on “shareholder value maximization” or “state capitalism”[6].

There are many interrelated factors that underlie economic mobility, as The World Economic Forum report indicates, and these will differ between countries. However, it is generally agreed that one consistent factor “explaining” intergenerational income mobility is simply a country’s wealth. In general, economic mobility is higher in richer countries than in poorer ones, so economic development benefits both absolute economic mobility (higher pay in successive generations) and relative mobility (chance to do better than your parents on the income scale) of people in developing countries[7]. But even among countries at the productivity frontier there are clear differences in mobility which do not correlate neatly with how rich the country is, as is apparent from The Great Gatsby Curve and the results we’ve discussed above. For example, Canada has considerably more intergenerational income mobility than the US[8].

| Why Are Income Mobility and Income Inequality Linked? Since income inequality and mobility are so closely correlated, one might think that anything that decreases income inequality would also tend to increase mobility. But the causal relationship could go the other way: increasing income mobility could drive down inequality. Actually, both are almost certainly true as a couple of thought experiments show. Let’s suppose we could somehow make income inequality go away. If every family had the same income, kids would pursue education and earn incomes based on their interests, talents, and preferences rather than being constrained by economics relative to other families. Since their parents all had the same incomes, the children’s relative incomes would tend to be randomly higher or lower, and not by much, which would essentially allow for complete income mobility as we’ve defined it. Other things being. On the other hand, if we could wave a wand and remove all impediments to children pursuing any career or business as freely as children in different economic circumstances, in short remove the link between parent’s incomes and children’s potential incomes, then income inequality would also tend to decrease. Why? Because there would be a greater supply of, say, dentists thus driving down dentists’ incomes (I beg the forgiveness of dentists). Other things being equal. It should be clear that the two thought experiments amount to much the same thing. Policies that increase mobility or decrease inequality both tend to drive countries down The Great Gatsby Curve. Now in both cases I mentioned “other things being equal”. What “other things” than parents income inequality drive kids’ income inequality in the aggregate? In addition to the many indicators used in the World Economic Forum study, kids will have different talents and interests and preferences, but we assume that applies to all kids equally. Some authors point out that there could be cultural differences among groups that influence their choices of, and aptitude for, certain professions. My personal feelings are that people adapt pretty quickly to opportunity. A more important “other thing” is capital income. By focusing on labor income, we’ve implicitly left out capital income, which is quite substantial. We’ll include that shortly. A third “other thing” is the distribution of opportunity geographically. As we mentioned in the case of Peru, there are depressed sections of the country, and this will tend to increase income inequality and reduce calculated overall mobility. And a final “other thing” we have to mention is the treatment of groups within an economy. People with certain accents or features or other differences may not be fully integrated into an economy as we mentioned is the case for Peru’s indigenous language speakers. |

In looking at income mobility in rich countries, many studies have focused on the high mobility and low-income inequality of the Nordic countries, often in contrast to the US. Denmark is one of these countries.

One of the main reasons why intergenerational mobility is higher in Denmark is precisely because inequality of incomes is lower. Below is a sample of occupations taken from the list we saw earlier in this section. For each occupation, the ratio of full-time wages in that occupation to the lowest paid occupation is shown for the US and Denmark.

Table 17: ratio of wages compared to lowest wage occupation in the US and Denmark. Source: US Bureau of Labor Statistics, The Mobile Statbank – Earnings by occupation, sector, salary, salary earners, components, sex and time[9]

| Occupation | US Relative Pay | Denmark Relative Pay |

| Family Medicine Physicians | 9.17 | 2.81 |

| General Internal Medicine Physicians | 8.66 | 2.81 |

| Chief Executives | 8.34 | 3.86 |

| Dentists | 7.87 | 2.38 |

| Registered Nurses | 3.33 | 1.57 |

| Loan Officers | 3.28 | 1.83 |

| Buyers and Purchasing Agents | 3.00 | 1.75 |

| Firefighters | 2.35 | 1.47 |

| Sheet Metal Workers | 2.34 | 1.33 |

| Carpenters | 2.27 | 1.38 |

| Postal Service Mail Carriers | 2.24 | 1.25 |

| Mental Health and Substance Abuse Social Workers | 2.22 | 1.52 |

| Childcare Workers | 1.10 | 1.11 |

| Cashiers | 1.05 | 1.00 |

| Cooks, Fast Food | 1.00 | 1.20 |

Scandinavian earnings were not always so compressed. What is now called the Nordic model was quite consciously developed over time starting in the 1930s. There is a high level of unionization in these countries now and wages are negotiated by representatives of labor, employers, and the government. Trade union “density” is 67% in Denmark and 12% in the US. Other aspects of the Nordic model include a strong social safety net which actually makes it easier for companies to hire and let go workers as needed in response to business opportunity. While unemployment benefits are generous, they are not unlimited, everyone is expected to work if they can. High levels of taxation support benefits that are available to everyone and not tied to income. These benefits include high quality education and healthcare, housing allowance and elder care. As almost any economics piece on the Nordic model will tell you, surveys of happiness put these countries at the top of the list. These are all capitalist countries with private ownership of business[10]. US GDP per capita was $70,248 in 2021, while Norway’s was $89,154, so the Nordic model certainly doesn’t have a negative effect on productivity[RF1] .

We began this section by defining the American Dream as a society where anyone can get ahead by hard work. Let us conclude the section by looking in detail at a study of how economic opportunity is distributed in the US in comparison with the Nordic countries and the United Kingdom[11]. This study looked at how often sons and daughters of parents from one income quintile (for example the bottom 20%) move into another income quintile (for example, the 60% to 80% income quintile). The income persistence numbers we’ve been looking at are single numbers and don’t tell us if opportunity is distributed differently at different levels of income, but looking at how often sons and daughters move out of the quintile in which they were born does tell us that. Only earnings were included, not transfers. To make sense of the results, remember that if opportunities were equally distributed one would expect children from every economic background to be equally likely to end up in any of the quintiles. In other words, 20% of kids of fathers in any quintile would end up in each quintile. Diving right in, here is a summary of the results. Like other studies, this one shows that overall mobility is lower in the US than the UK which in turn has lower mobility than the Nordic countries. In all the countries persistence is high at the top quintile of the income distribution, in other words kids of the well off are likely to end up earning like their parents. Over 30% of sons and daughters of fathers in the top quintile end up there also in all the countries. Perhaps surprisingly, mobility is quite similar between the US, UK, and Nordic countries in the middle of the income distribution. What really sets the US apart is that mobility out of the lowest income quintile group is lower in the US than in the other countries. This applies to men in particular: there is a 42% chance that sons of fathers in the lowest income quintile will also be in the lowest income quintile. This is the highest “persistence” of any country and quintile. While the results for women suffered from a lack of data, the study concludes that daughters born into poor families in the U.S. have a much higher probability of climbing up the income distribution than their brothers. The out-of-poverty mobility for women is almost at the same level as for the other five countries, i.e. around 75 per cent[12].

In other words, intergenerational mobility was about as good for the US middle class as it was in the Nordic countries using data from the time period in question. Since wages, even before taxes and benefits, are much less equal in the US than the Nordic countries the differences between quintiles in dollars is also much larger here, which could well explain why us middle class Americans feel like the American Dream is still possible. Our kids can grow up to be surgeons and earn big bucks. However, that is far less likely if you’re a male born to poor parents in the US compared to the Nordic countries.

Finally, none of this relates specifically to starting and growing a business.

“When the World Bank ranks countries on ease of doing business, based on criteria such as starting a company, dealing with construction permits, getting credit, trading across borders, enforcing contracts, or paying taxes, the Nordic countries consistently rank among the most business-friendly nations in the world. In fact, on those criteria, American entrepreneurs would be better off in Denmark, which scored higher than the US in the 2015 ranking.”[13]

Overall if by the American Dream we mean opportunity for all, the US is no longer exceptional or even a particularly good example.

There is one group for whom both the US, the Nordic countries, or indeed any rich country, provides an extreme and immediate huge boost in income mobility for both parents and children, and that is migrants. When migrants leave a poor country for a rich one, they immediately boost their incomes and their kids’ opportunities. We’ll look at this in the next chapter[RF2] .

[1] This elegant formulation is from Investopedia https://www.investopedia.com/terms/a/american-dream.asp.

[2] Corak, Miles. 2016. “Inequality from Generation to Generation: The United States in Comparison.” SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2786013. Also Here is the source for the “Great Gatsby Curve” in the Alan Krueger speech at the Center for American Progress on Jan 12, 2012. A similar chart is in the World Bank “Fair Progress?” report on page 141.

[3] Economic Mobility and Fairness in a Developing Country: Evidence from Peru IZA DP No. 16465 available at https://docs.iza.org/dp16465.pdf. This deals with wealth mobility but income and wealth mobility are correlated.

[4] World Bank Group. 2018. “Fair Progress? Economic Mobility across Generations Around the World.” World Bank Group. https://www.worldbank.org/en/topic/poverty/publication/fair-progress-economic-mobility-across-generations-around-the-world.

[5] “Global Social Mobility Index 2020.” 2020. World Economic Forum. January 19, 2020. https://www.weforum.org/publications/global-social-mobility-index-2020-why-economies-benefit-from-fixing-inequality/.

[6] Global Social Mobility Index 2020 page 5. See the discussion later in this chapter on the Nordic Countries.

[7] See page 2 in World Bank Group. 2018. “Fair Progress? Economic Mobility across Generations Around the World.” World Bank Group. https://www.worldbank.org/en/topic/poverty/publication/fair-progress-economic-mobility-across-generations-around-the-world.

[8] For a discussion of possible reasons, see Corak, Miles. 2016. “Inequality from Generation to Generation: The United States in Comparison.” SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2786013.

[9] The Danish wage information is from 2013, but while wages go up year to year, the ratios don’t change much.

[10] Brief introductory information on the Nordic model can be found on Investopedia and Wikipedia as well as the Danish government web site, https://denmark.dk/society-and-business/the-danish-welfare-state

[11] Jantti, Markus, Bernt Bratsberg, Knut Røed, Oddbjørn Raaum, Robin A. Naylor, Eva Osterbacka, Anders Bjorklund, and Tor Eriksson. 2006. “American Exceptionalism in a New Light: A Comparison of Intergenerational Earnings Mobility in the Nordic Countries, the United Kingdom and the United States.” SSRN Electronic Journal. https://doi.org/10.2139/ssrn.878675. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=878675

[12] Appendix tables 1.2 and 1.3 of Jantti et al.

[13] Finnish journalist Anu Partanen in her book, “The Nordic Theory of Everything – In Search of a Better Life” as quoted in Forbes in 2016 https://www.forbes.com/sites/eshachhabra/2016/07/24/why-the-nordics-are-the-best-place-to-run-a-business-and-live/?sh=2ac988891ed9

[RF1]Unfair because of oil revenue

[RF2]Future topics

- Mobility over time

- Wealth Mobility